cayman islands tax treaty

A in the Peoples Republic of China. Agreement between the Government of the United States of America and the Government of the Cayman Islands for the Exchange of Information Relating to Taxes.

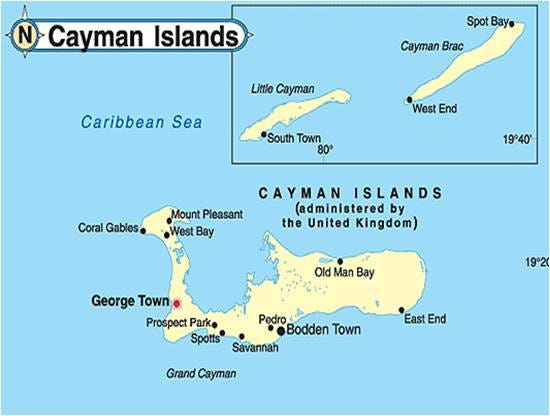

Cayman Islands Government And Society Britannica

It has however entered into limited tax treaties with the UK and New Zealand and signed a comprehensive tax treaty with Japan in 2010 see.

. Refer to the Tax Treaty Tables page for a summary of many types of income that may be exempt or subject to a reduced rate of tax. Our team of Cayman Islands incorporation agents presents some of the main issues included in the treaty. Navigate the tax legal and economic measures in response to COVID-19.

The Multilateral Convention on Mutual Administrative Assistance in Tax Matters which allows tax information exchange with more than 140 countries. At the time of signing of this Agreement between the Government of Canada and the Government of the Cayman Islands under Entrustment from the Government of the United Kingdom of Great Britain and Northern Ireland for the Exchange of Information on Tax Matters the undersigned have agreed upon the following provisions which shall be an integral part of this Agreement. The Cayman Islands landmark 12th tax information exchange agreement was signed with New Zealand in August 2009 moving the jurisdiction onto the whitelist of countries that have substantially implemented the OECDs internationally agreed tax standard.

The Agreement provides for exchange of information on request in both criminal and civil tax matters. This page was last updated on 28 June 2019. Cayman Islands TIEA 13071 KB.

Does not have a tax treaty with the Cayman Islands and as a result there are no benefits for Cayman Islands Expat Tax from this perspective. THE GOVERNMENT OF THE CAYMAN ISLANDS UNDER ENTRUSTMENT FROM THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND. US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax.

16 hours agoThe Reg 1515 is a monthly 15-minute webcast released by our Cayman Islands Regulatory team on the 15th day of each month providing timely updates on current regulatory developments. International treaty Cayman Islands. Canada - Cayman Islands Tax Treaty.

The Caymans have become a popular tax haven among the American elite and large multinational corporations because there is no corporate or income tax on money. Tax treaties Details of tax treaties in force between the UK and Cayman Islands provided by HMRC. In the case of the Cayman Islands the Tax Information Authority or its delegate.

The March 2022 webcast covered the following topics. The Governments of Australia and The Cayman Islands have signed an Agreement for the Exchange of Information Relating to Taxes. Cayman does not have legal mechanisms or treaties such as double taxation agreements in place with other countries to legally transfer tax bases from one country to another in order to aggressively reduce taxes.

Hereinafter referred to as Chinese tax b in the Cayman Islands. Determining Alien Tax Status. Foreign tax relief.

G The term Financial Institution means a Custodial Institution a Depository. For the UK the covered taxes are the income and the. 1 345 914 8616.

The Cayman Islands does have a double tax treaty with the UK but it is narrowly drafted and therefore can only be relied upon in certain limited circumstances. Taxes of every kind and description. See the Other issues section in the Corporate summary for a description of Bilateral Agreements that the Cayman Islands has entered into.

WHEREAS the Government of the United Kingdom has issued a letter of entrustment to the Government of the Cayman Islands hereinafter Cayman Islands to. Since then the number of TIEAs that Cayman has in force has proliferated. Tax services and publications.

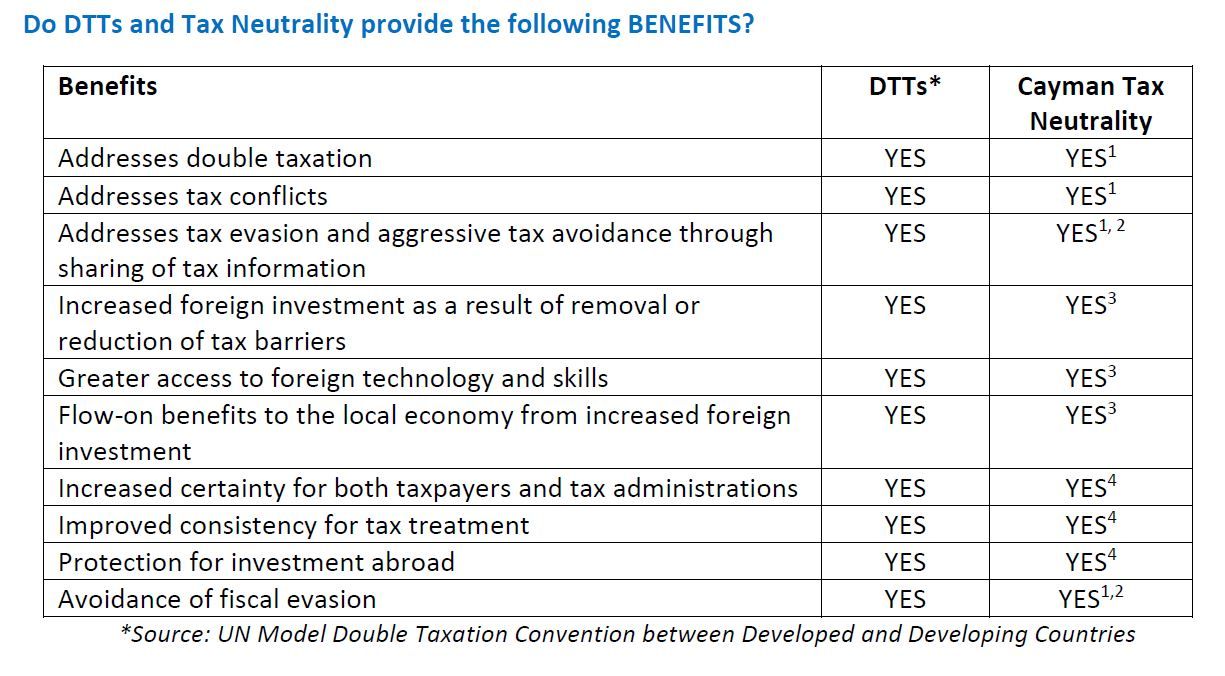

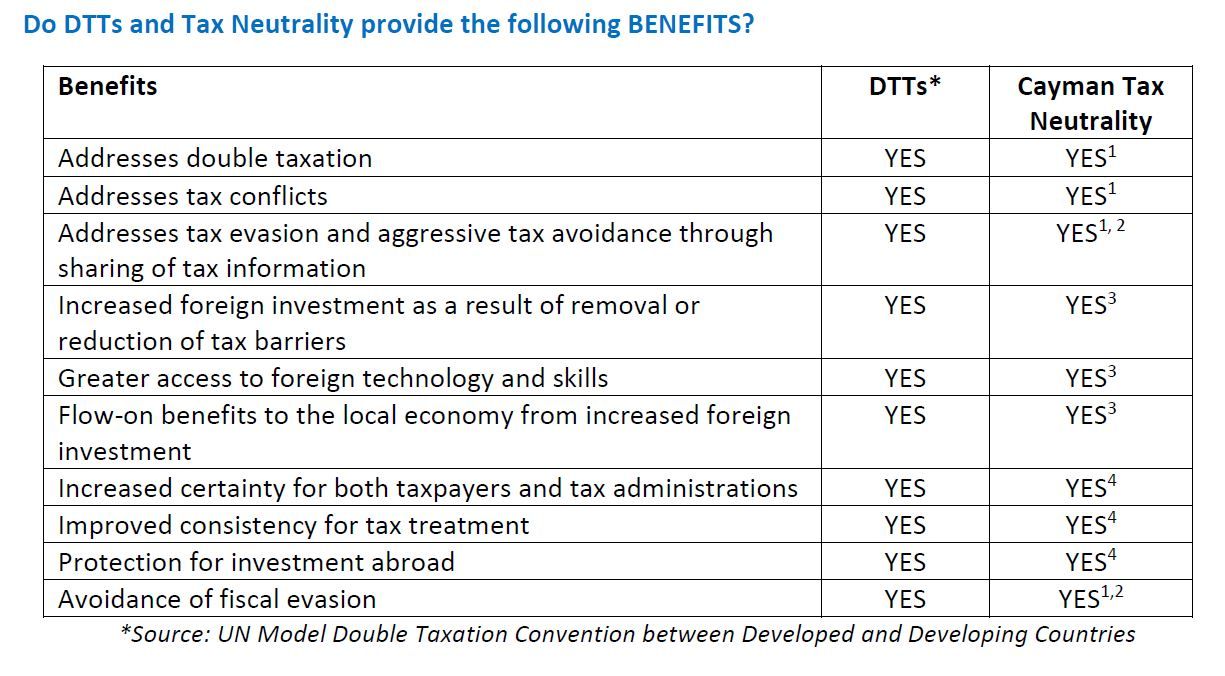

Partner PwC Cayman Islands. OECD invites taxpayer input on ninth batch of dispute resolution peer reviews. The Cayman Islands Tax Neutral regime meets the criteria of an alternative tax policy model.

Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions. The signing took place on 30 March 2010 in Washington DC with Ambassador Beazley signing on behalf of. Agreement between the Government of the Cayman Islands and the Government of the United States of America to Improve International Tax Compliance and to Implement.

The DTA applies to individuals natural or legal who are residents of one or both jurisdictions. Exchange of Notes with Spain. Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any double tax treaties with other countries.

EU AML High-Risk Third Countries List. Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation. The Agreement between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland including the Government of the Cayman Islands for the Exchange of Information Relating to Taxes done on November 27 2001 at Washington the 2001 Agreement shall terminate on the date of entry.

For further information on tax treaties refer to the International Tax page of the US. The OECD is now gathering input for the Stage 1 peer reviews of Andorra Anguilla Bahamas Bermuda British Virgin Islands Cayman Islands Faroe Islands Macau China Morocco and Tunisia and invites taxpayers to submit input on specific MAP-related issues by 12. Cayman Islands Foreign Bank Account Reporting The FBAR FinCen Form 114.

Department of the Treasury. All taxes except customs tariffs. Capital Gains Tax CGT for Non-UK Residents.

The existing taxes to which this Agreement shall apply are in particular. Diplomatic Note with the Cayman Islands. Tax Laws in the Cayman Islands.

Cross-border economic transactions involving the Tax Neutral jurisdiction of the Cayman Islands do not require tax treaties as there is. Claiming Tax Treaty Benefits. Tax treaties Tax treaties and related documents between the UK and the Cayman Islands.

Automatic data exchange as part of the European Union Savings. Hereinafter referred to as Cayman Islands tax This Agreement shall also apply to any identical or substantially similar taxes that are.

Cayman Islands Profile Bbc News

History Of The Cayman Islands Explore Cayman

Tax Advice For Uk Citizens Moving To Cayman Cayman Resident

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

Why Coronavirus In Cayman Risks Brazilian Offshore Assets By Matthew Feargrieve Medium

Are The Cayman Islands Tax Neutral Oasis Land Development Ltd

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist St Lucia News Room

What Makes Cayman Islands So Popular For Hedge Funds International Finance

The New G7 Minimum Tax Initiative And The Cayman Isl

Cayman Islands Tax Neutrality Overview Tax Cayman Islands

Lowtax Global Tax Business Portal Double Tax Treaties Introduction

Registration Of Company In Cayman Islands Offshore In Cayman Islands Company Registration For Business Purposes Law Trust International

A Guide To Cayman Island S Taxation System Zegal

How To Move Your Business To Cayman And Pay No Tax Escape Artist

How To Open An Offshore Bank Account In The Cayman Islands

Here Are Some Of The Most Sought After Tax Havens In The World

Cayman Islands Profile Bbc News

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World